#002: Why blockchain

In 2009, Satoshi Nakamoto developed Bitcoin (BTC), hailed as a revolution in monetary finance, while the introduction of Ethereum’s (ETH) smart contracts truly brought blockchain into the public eye as a foundational infrastructure.

What is Blockchain?

When people hear “blockchain,” many think of anonymous electronic cash. Indeed, the concept of anonymous digital currency was the precursor to Bitcoin. In the 1980s and 1990s, anonymous e-cash protocols relied primarily on a cryptographic primitive called Chaumian blind signatures, offering a highly private form of money. However, these protocols largely failed to gain traction because they depended on centralized intermediaries. This eventually led to the creation of Bitcoin by Satoshi Nakamoto.

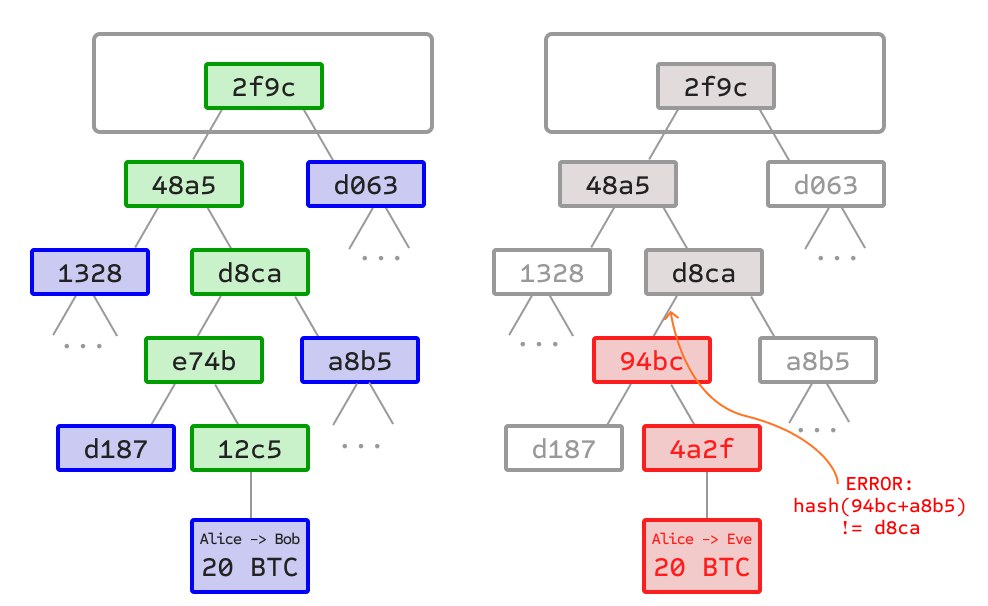

As the name suggests, a blockchain is composed of a chain of blocks. Each block forms an unalterable chain with the others. A key feature of Bitcoin is that its blocks are stored in a multi-layered data structure. The hash of a block is actually just the hash of the block header—a piece of data about 200 bytes in size that contains a timestamp, a nonce, the hash of the previous block, and the hash of the Merkle root. The Merkle root is a binary tree structure made up of a set of leaf nodes, intermediate nodes, and a root node. Any change in a node would cause the entire Merkle root to change.

This makes it extremely costly for an attacker to achieve their desired outcome, often with profits that don’t even outweigh the costs of mining.

The left image illustrates an example of a Merkle root.

The left image illustrates an example of a Merkle root.

The right image shows how tampering with any node in the Merkle tree leads to a change in the entire Merkle root.

Characteristics of Blockchain

Decentralization

Blockchain isn’t operated by an individual or a single company or institution but by countless nodes. Anyone can join this revolution. Anyone can set up their own node to mine and earn substantial rewards.

Honest nodes control the vast majority of the network, though there are also malicious nodes. Fortunately, they do not control 51% of the honest nodes.

Immutability

Blockchain follows the longest chain principle. If Miner A and Miner B both mine different blocks at the same time, it doesn’t result in two separate blockchains. Instead, it causes a temporary fork—Miners following Miner A and others following Miner B. Since blockchain adheres to the longest chain principle (i.e., whichever chain accumulates the most Proof of Work), it’s a fair race. If Miner A is in a more favorable network location and its block announcement reaches more nodes, more blocks will follow it, and Miner A wins.

It is because of this characteristic that if an attacker wants to tamper with a block, they would need to control the majority of the world’s nodes (a 51% attack). No computer in the world today can generate that much computational power. If someone actually managed to alter the blockchain, that attacker would likely be from the future.

Anonymity

A blockchain account consists of a public key and a private key. Each public key corresponds to a private key. The blockchain does not reveal where you are from or what activities you’ve participated in.

It only knows what transactions you’ve made—for example, how much BTC was sent to which address. Of course, if you publicly share your address on social media, that’s a different story.

Before attempting to leak your address, remember: the blockchain is a dark forest.

Transparency

Traditional bank accounts are generally not accessible to ordinary people. If a bank insider secretly transfers your money to another account and then back, you would hardly notice. Even if certain groups engage in insider trading, it’s almost impossible to detect.

Blockchain solves this issue effectively. Every action on the chain is recorded. Remember, the blockchain itself is a decentralized ledger.

A side note: This is how many meme coins come into existence. Someone discovers a coin, finds out it was issued by a famous person, and suddenly—a narrative is born.

Applications of Blockchain

Given its many excellent features, its applications are highly forward-looking.

Admittedly, a counterargument might be that many blockchain applications are centralized. This isn’t an exaggeration—it’s simply the reality.

If a legitimate company wants to develop blockchain technology, it must go through government approval processes involving audits, security reports, and more. I won’t delve into the details here.

So, does this betray the original intention of decentralization?

I can’t provide a definitive answer. I can only say it’s beyond our control. Your information remains yours alone—unless you enter the blockchain industry, in which case your information will naturally be exposed.

Blockchain applications still face centralized constraints because, without centralization, it’s difficult to gauge credibility.

Isn’t that ironic?

We live in an open era—free and passionate.

We live in a regulated era—transparency squared.

Conclusion

The emergence of blockchain has shortened the world’s distances. The world is no longer defined by continents and straits. Through blockchain, we can effortlessly transmit information from Antarctica to the Arctic Ocean. Anonymous electronic cash can resist the traditional cash issued by banks.

However, anonymity also comes with risks. The chain is filled with all kinds of hackers and various scams. Before fully understanding the concepts, tread carefully on the chain.

Even though blockchain has been developing since 2009, it remains at the forefront of the industry. The future is still full of limitless possibilities—provided you are smart enough.